Estate Planning is an important part of financial planning. It is necessary to have an estate plan in place so that your wealth is transferred to intended beneficiaries without hassles. It is not a simple process and therefore enlisting the help of a financial planner or a professional will help you in getting it right. Estate means the net worth of a person. Estate planning refers to making arrangements such that your wealth is taken care of and distributed to beneficiaries, as you desire after your death without too many legal hassles. It is an important aspect of personal finance and financial planning, irrespective of how big or small your net worth is in your opinion. It is better to take professional assistance for estate planning, as it is a tough task.

It is important to review/update the plan once in a while. Some reasons which could mean an update to the estate plan include:

It is important to have an estate plan in place. Otherwise, the estate would be given to legal heirs, as per the existing laws of the state, and not in the manner you had in mind. It has to be in place so that there are no complications on how your wealth should be distributed after your death.

What Is Tax Planning?

Tax planning is a method by which one studies and avails of the deductions, exclusions,

allowances, and exemptions provided by the Government of India to save on income tax.

One needs to know which income tax slab they fall under. A careful study of the

deductions available needs to be made and only those availed which make one comfortable.

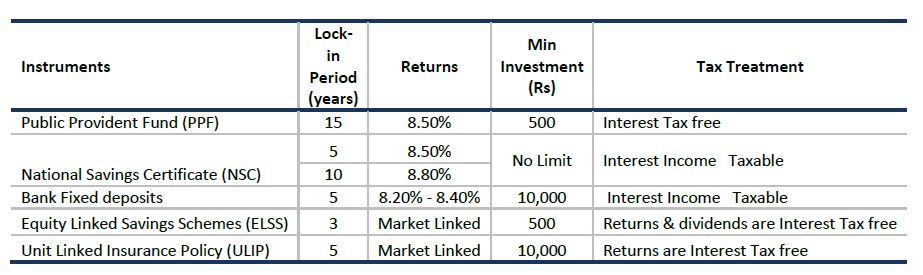

One needs to make time an ally and start planning for taxes as early as possible and not wait until it is too late. Comfort in tax planning basically depends on one's capacity to bear or tolerate risk. If one has a conservative bent of mind and is averse to taking risks, they must make use of fixed-income securities where the principal is not at risk. If one has a higher tolerance towards risk, then equity-linked savings schemes are the way to go.

The time horizon also plays a very important role in determining one's ability to bear risk. If one is older and around 50 years of age, a Public Provident Fund (PPF), which has a 15-year minimum lock-in period for the amount invested, might not be suitable. If one is young and has a lot of time on their side to invest (known as a long-term horizon), then an aggressive instrument such as equity-linked savings schemes is an apt choice.

Tax planning needs to be flexible and not set in stone. It is an ongoing or dynamic process which has to be tweaked according to one's need. It is a sound test of one's decision-making ability. It involves research and a study of changes in income tax laws and their impact on one's tax liability.

The final decision in tax planning is the calculation of one's income tax liability based on the income tax slab they fall under and a judicious selection of the right avenue to save income taxes based on risk tolerance.

In order to encourage savings, the government gives tax breaks on certain financial products under Section 80C of the Income Tax Act. Investments made under such schemes are referred to as 80C investments.

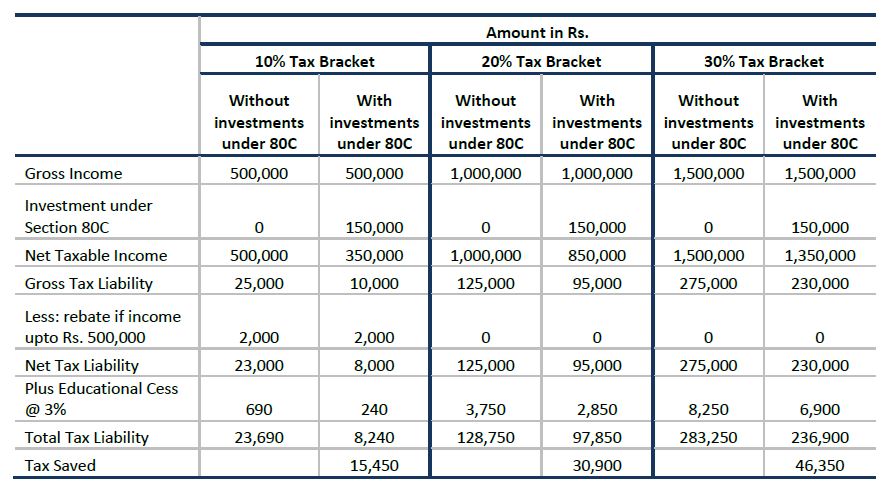

Section 80C of the Income Tax Act, 1961 allows certain investments and expenditures up to a maximum of Rs. 150,000/- to be deducted from total income for tax computation for the current financial year. If you are in the highest tax bracket of 30%, you save a tax of Rs 46,350/- as illustrated in the table below:

The deductions available under Section 80C of the Income Tax Act allow individuals and Hindu Undivided Families (HUFs) to reduce their taxable income through investments in various financial products. Here are the key features:

The following are some of the most common investment options under Section 80C:

Ensure you keep the relevant receipts and documentation to claim deductions effectively under Section 80C. It's important to choose the right investments based on your financial goals and risk tolerance.

Tax Planning and Investment

Tax Planning: Beyond Saving Taxes

Tax planning is not just about saving taxes; it also plays a critical role in helping you achieve your long-term financial goals. While there are numerous schemes available for tax saving, Equity-Linked Savings Schemes (ELSS) stand out as an option that not only provides tax savings but also aids in wealth generation. This is because ELSS invests heavily in equities, which have the potential to deliver higher long-term returns.

Disclaimer:

@ Tax benefits are subject to the provisions of the Income Tax Act, 1961 and are subject to amendments, from time to time.

Certain information contained in this document is compiled from third-party sources. Whilst Mirae Asset Global Investments (India) Private Limited has, to the best of its endeavor, ensured that such information is accurate, complete, and up-to-date, and has taken care in accurately reproducing the information, it shall have no responsibility or liability whatsoever for the accuracy of such information or any use or reliance thereof.

This document shall not be deemed to constitute any offer to sell the schemes of Mirae Asset Mutual Fund. Mirae Asset Global Investments (India) Pvt. Ltd./ Mirae Asset Trustee Co. Pvt. Ltd./ Mirae Asset Mutual Fund/ its Directors or employees accept no liability for any loss or damage of any kind resulting out of the unauthorized use of this document.

Mutual funds are subject to market risks, read all scheme-related documents carefully.

Why is Tax Planning Necessary?

Tax planning is essential for individuals who want to minimize their tax burden while achieving financial security. For those who are "generous" towards the government or extremely wealthy, it may not be a priority. However, for most people, tax planning is a must.

The primary aim of tax planning is to limit income tax liabilities by taking advantage of various tax deductions, exclusions, and exemptions provided by the government. Without proper tax planning, individuals end up paying more tax based on the tax slab they fall under. By implementing the right strategies, individuals can reduce their taxable income and save on taxes that would otherwise need to be paid in full.

Proper tax planning also allows individuals to make the most of their financial resources and investments, helping them achieve their long-term financial goals with greater ease.

Start Your Investing journey today by signing up with Indian Investment

Services.

Happy Investing 😊